Home

Cascade Capital is an investment advisory guiding clients on value-based investments in Indian capital markets. Our clientele includes corporate executives & businessmen who appreciate wealth creation through equity investments.

We focus on deep-value investments, special situations & long-term equity to find low-risk high-return opportunities for our clients. We borrow our investment framework from the Warren Buffett & Ben Graham school of thought that an investment operation is first about protecting capital & then about generating returns.

We are strong believers in the principle of skin-in-the-game & like to eat our own cooking. Our Principal’s capital is co-invested into every investment that is recommended to clients.

Investment Philosophy

We focus on value-based investments in Indian capital markets. We draw inspiration from Ben Graham/Warren Buffett school of thought that successful investing is about betting only when the odds are overwhelmingly in your favour & chances of permanent loss are low. An investment operation is first about protecting your capital & then about generating returns.

The Business of Investing

As Mr Buffett says 'We are in the business of buying businesses'. We are not in the game of speculating on stocks or into predicting the next fancy high-flier in the market. We spend all our time & energy digging out undervalued companies.

We aim to buy part-ownership in businesses that are attractively-priced in Indian capital markets. The advantage of scouting capital markets (vs private deals) is that market participants often succumb to short-term emotions of fear & greed. It, thus, becomes a very fertile ground of opportunities for any rational buyer of businesses. And when conditions to produce bargains materialize, we are ready to deploy capital. Market mispricings are creators of opportunities for our clients.

We specialize in finding bargains in the areas of deep-value investments, long-term equity & special situations. Do look at our case studies section & you'll get an idea of how some mispricings have thrown some opportunities at us that gave us outsized returns.

Skin in the Game

We are strong believers in the principle of skin-in-the-game & like to eat our own cooking. Our principal's capital is co-invested along with our clients' money in every investment, often to a much larger extent than any individual client's commitment.

Margin of Safety

We invest only when chances of permanent loss of capital are low. In other words, every investment is made only when there is a wide gap between its price & its value. This leaves us with a large margin of safety in case things don't go as we expect them to.

Principal

Prashant Rishi

Prashant Rishi is the founder & investment principal at Cascade Capital. After passing out of IIM Lucknow in 2012, he worked for Hindustan Unilever Ltd for 3.5 years as a Finance Manager, closely involved with many critical distributor-facing financial decisions. His work gave him a solid understanding of both B2B & B2C business space in India.

He decided to start Cascade Capital after coming across the investment philosophy of Warren Buffett & after realizing how odds in capital markets are stacked heavily in favor of the patient rational investor. He has been investing his own capital in Indian equity markets, based on these principles, an experience which has produced stellar results for him & his co-investors. Some of these have been mentioned in the Case Studies section.

He is passionate about learning about businesses and, in his free time, helps many private businesses take rational capital allocation decisions. He is also an avid reader & loves playing contract bridge.

He can be contacted at: principal@cascadecapital.in

Case Studies

This section features some of the investments made by us in the past. These are not investment recommendations. We, or our clients, do not hold positions in any of the stocks mentioned. As a practice, we will never write about stocks that our clients are currently invested in.

The purpose is only academic, i.e. to highlight the thought process that went behind selection of some of our past investments.

While our counterparts in VC firms believe in investing massive sums of money in cash-burning operations of domestic e-com industry, we believe in committing capital only in firms that produce cash consistently.

Mr Buffett says 'We want to invest in businesses that drown us in cash'. We wholeheartedly agree with him.

This investment was made not only in a cash-generating company but was also made at ridiculous terms. One could buy Danlaw Technologies, a zero-debt, positive cash-flow machine, at a price less than the cash on its books. In other words, net purchase price of business (after netting excess cash from market capitalization) was negative. You were effectively getting paid for holding a cash-generating machine.

Danlaw Technologies is a Tier-1 automotive-electronics vendor to General Motors & Ford. It has been in business over last 20 years. Reputation of a vendor with its customers is paramount in any B2B business & one can get an idea about Danlaw’s reputation by looking at its pricing power: it consistently maintains gross margins of 80%+. It had zero debt & a very small amount of contingent liabilities. Except for FY'11, it had positive operating cash flow in every year over last 5 years. Corporate structure of its business is typical of Indian IT setups wherein a US-based subsidiary, which bills clients in the US, is billed by the listed Indian company.

Markets were valuing this company at ₹ 3 cr in Apr’14 despite cash balance of ₹ 13 cr on company's books. This cash was lying in company’s SBI bank account & was earning FD interest rates prevailing at that time. A year later, its cash balance increased modestly to ₹ 13.3 cr while market cap more than doubled to ₹ 7 cr. Despite such a jump in share price, business was selling below cash-level on books: a gross mispricing, waiting to be exploited. We started accumulating its shares at market cap of ~₹ 7.4 cr.

Over next 6 months, cash balance increased to ₹ 16.38 cr while market cap jumped to ₹ 22 cr. By Jan'16, mkt cap rose further to ₹ 40-45 cr while our estimate of cash on company's books at this time was ~₹ 18 cr. Any maintenance of investment position in the company at this stage would require a solid understanding of prospects of auto-industry in the US. This is the point where we started selling & could exit our investment at market cap of ~₹ 45 cr.

On the whole, this investment operation gave us a whopping 540% return on invested capital in 8 months’ time.

Some people argue that best deals in business are available only to those with heft, and that a retail investor has no edge over heavyweight institutions. While there is some truth to this argument, capital markets have proven to be a very fertile ground for opportunities for a rational buyer of businesses, irrespective of the size of his capital. No matter how good your negotiating skills are, can you imagine buying a business at below-cash levels in a private business deal? Which promoter is dumb enough to sell his business to you at such terms! And yet, markets keep throwing such no-brainers at us from time to time. There are many opportunities where there is no relation between the price you pay for the business & value you receive in return.

Disclaimer: This is not an investment recommendation of this scrip. Only an indicative case to show how capital markets throw such opportunities to the patient buyer. We, & our clients, have no position in Danlaw Technologies currently.

Mean reversion is a very powerful force in cyclical industries like metals, real estate, infrastructure, etc. The fortunes of businesses in these industries swing like a pendulum between euphoria & despair.

In times of bullishness, every new promoter wants to open a business in these industries & existing promoters want to expand their capacities. Prices of output keep rising. Companies take on excessive debt to fuel their expansion dreams quickly. (Nothing sedates rationality like large doses of effortless money. - Warren Buffett). Mood is euphoric & the sector becomes a darling of capital markets as every firm is priced much higher than what is justified by its fundamental earning power. This leads to excess capacity which eventually drives down the price of output. Pendulum now starts to swing towards despair. Many over-leveraged players perish as they are unable to pay down even their interest cost, let alone the principal. Banks get stuck with NPAs & companies start deleveraging by selling their crown jewels. Mood turns to despair & markets start to hate the once-loved sector. At such times, even fundamentally-sound businesses get re-priced to bargain valuations.

MOIL was one such business that was available at the bottom of the manganese ore cycle at throw-away prices. The company is the largest miner of manganese ore in India. It operates 10 mines, located in MP & Maharashtra. Manganese ore is used in the manufacture of silico-manganese & ferro-manganese both of which are critical inputs in the steel-making process. Since end-user of its output are steel plants, demand for manganese ore depends on the performance of domestic steel industry.

Manganese ore is a freely imported commodity in India. So, despite being the largest miner in the country, MOIL is a price-taker & its output is priced on parity with global manganese ore prices. Its end-customer (domestic steel industry) is also a commodity business.

Zero pricing power & cyclically-fluctuating prospects of both this industry & its consumer industry make for a brutal business combination. And equity markets give a very low valuation to such businesses when the pendulum swings to the extreme of cyclically low prices. This happens because markets assume that current prospects of the business will prevail forever. While permanently poor valuations are justified for businesses with broken business models (your favorite e-com sites), in cyclical businesses this tendency of the market produces mispricings that can be exploited by the patient, rational buyer.

The investment operation involves buying the business when prospects are at their worst & valuations are near the liquidation value of assets. Usually, pendulum starts to swing in the other direction in 2-3 years (depending on the industry) & market corrects its mispricing. Patient buyer of business is greatly rewarded when this happens & all the gains come in a very short period of time.

In case of MOIL, price of its output (manganese ore) had fallen year-long in 2015 to a decadal low. Such low prices meant short-term distress for all companies in this sector across the world.

For MOIL, it meant:

- Inventory accumulation: MOIL was stuck with unsold inventory of ~3 L MT on its books which was more than twice its average inventory holding

- Inventory write-down: For the first time in last 8 years, the company had to write-down its inventory by ₹ 21 cr given that prevailing Manganese Ore prices were so low.

- Throw-away valuation: At a price of ₹ 200/share, the business was quoting at a market cap of ~₹ 2660 cr when the books carried a cash balance of ₹ 2100 cr, with no debt. So, effectively one was paying ₹ 560 cr for an operating business that had produced annual operating cash flows of ₹ 360 cr on average. This was lower than even the liquidation value of the firm's assets. Only in the depths of pessimism does one get such bargain valuations in cyclical businesses.

MOIL's management had, in their con-calls with analysts, indicated that prevailing prices were the lowest price that they had seen in their experience. This indicated that we were close to the bottom of the cycle.

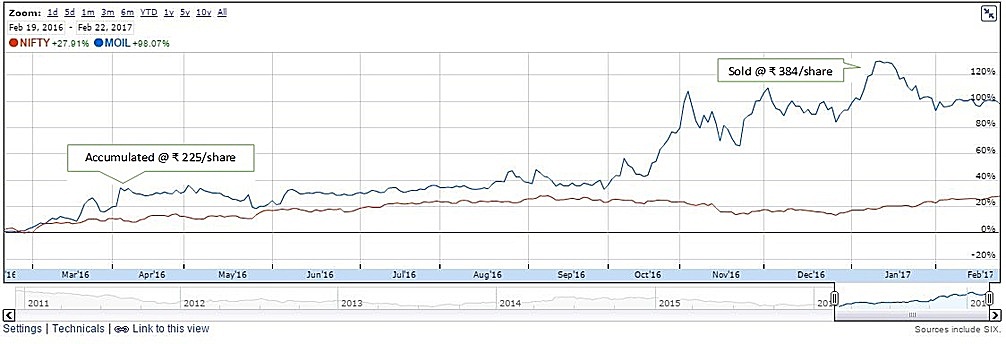

We started accumulating MOIL's equity in the months of March & April at an average price of ₹ 225/share. The sector was already showing some signs of revival, as indicated by the manganese ore prices in the chart below.

Over the next 9 months, prices of Manganese Ore increased & the company was able to sell all the excess inventory it had been stuck with. Since massive volume of inventory was sold over a fairly short period of time at high prices markets quickly repriced the stock giving us a quick 70% return over our holding period of 8 months. We exited our position at an average price of ₹ 384/share.

Note: Investing in cyclical industries is easier said than done. Often there is a tendency to succumb to the mass opinion that poor prospects of the industry shall prevail forever & it's very difficult to pick the bottom of a cycle. It's also psychologically difficult to keep averaging down in such scrips as prospects turn poorer (before eventually turning around). This is one investing theme that will make your stomach churn. But as we've found out, cheery consensus & high returns rarely go together.

PS:

- After accumulating the shares (@ ₹ 225/share) expecting reversion in manganese ore prices, we also conducted a number of arbitrage operations in this scrip. In the beginning of every quarter, MOIL announces to the stock exchanges the prices it will charge for its manganese ore output. Since we knew that prices had rebounded & that markets would react positively to these announcements, there was a lot of free money to be made.

- We also participated partially in a share buyback (tender offer) that was announced at a price of ₹ 248/share in Sept'16.

- We exited our position at an average price of ₹ 384/share for a return of 70% in 9 months’ time.

- We took an almost identical bet in the scrip of National Aluminium Co (another cyclical business) with similar returns, though our position was smaller here.

Disclaimer: This is not an investment recommendation of this scrip. Only an indicative case to show how capital markets throw such opportunities to the patient buyer. We, & our clients, have no position in MOIL currently.

Tender buybacks are a source of glaring inefficiency in Indian capital markets that any retail investor can exploit. Here’s how the operation works: a company announces that it will purchase its shares from its existing investors at a pre-determined price. Total number of shares that the company intends to buy is also announced. The shares of the company often quote at a good discount to the buyback price in the market. So, to make money, all an investor needs to do is buy them from the market & then sell them ('tender them') to the company through his brokers during the 2-week buyback period.

Following is the chronology of events in a tender offer:

1. Company announces a Board Meeting to consider a share buyback.

2. In the Board Meeting, terms of the buyback are approved: mode of buyback (tender offer/open market buyback), number of shares to be bought back & buyback price. These are announced to the exchanges

3. Shareholder approval is taken for the buyback through postal ballot.

4. Record Date is announced to determine the list of shareholders eligible to participate in the buyback. An investor must hold shares 2 days before record date in his demat a/c to participate in the tender offer.

5. Buyback period starts, usually 2-3 weeks after the Record Date. It lasts for 10 working days. Investors need to contact their brokers for tendering their shares.

6. 2 weeks after the buyback period ends, the investors who tendered their shares receive the money from company, along with unaccepted balance shares, if any.

Since the number of shares that the company purchases is fixed & total number of shares tendered by investors usually exceeds this, shares are accepted on a proportionate basis. Needless to say, lesser is the total tendering, better are the chances of acceptance by the company.

Eg. If a company announces that it will buy back 50 L shares & investors together tender 1 cr shares, then the company will accept 1 share for every 2 tendered. So, if an investor tenders 10 shares, 5 will be accepted by the company while the balance 5 will be returned to his account after the buyback period. The acceptance ratio here was 50%.

Small shareholder Reservation & High Theoretical Acceptance Ratio

Any investor who was holding shares worth less than ₹ 2L, on the record date, is known as a small shareholder. If the share price on record date was ₹ 200/share, a small shareholder would be defined as any investor who held less than 1,000 shares (₹ 2,00,000/₹ 200) across all his demat a/cs.

According to SEBI rules, every tender buyback must reserve 15% of buyback size for small shareholders. In the above example, where the company intended to buy back 50 L shares, it would purchase 7.5 L shares (15% of 50 L) from small shareholders. Only in cases where total shares tendered by small shareholders are less than their reservation, will large shareholders be able to participate in this reserved portion.

Let’s define theoretical acceptance ratio as the acceptance ratio if all shareholders were to tender their shares in the buyback.

Because of 15% reservation, the theoretical acceptance ratio for small shareholders is much higher than that for other (large) investors.

For small shareholders,

Theoretical acceptance ratio = 15% of buyback size/number of shares held by small investors

Since the number of shares held by small shareholders is quite small usually, theoretical acceptance ratio for them tends to be quite high.

For large shareholders,

Theoretical acceptance ratio = 85% of buyback size/number of shares held by large investors

If you've studied the shareholding structure of any company, you'll know that most shares are held by large shareholders. Thus, the theoretical acceptance ratio for large shareholders tends to be quite poor (often less than 5%) since buyback size is usually quite small, compared to total shares outstanding.

Actual Acceptance Ratio

Despite a high theoretical ratio, small shareholders rarely tender shares in buybacks. If you observe the post-buyback disclosures, you'll see that small shareholder portion is (almost always) undersubscribed. May be they are ignorant about the reservation. May be they are just lazy. Whatever the reason, this is equivalent to market throwing away free money & people not turning up to collect.

To summarize, inefficiency creeps in due to two reasons: firstly the small shareholder quota gives a higher theoretical acceptance ratio & secondly, the ignorance of most small shareholders gives an even higher actual acceptance ratio to those who participate.

In fact, in any tender buyback, if the theoretical acceptance ratio crosses 40%, it's a safe bet that the actual acceptance ratio for the small shareholder will be 100% (obviously, this ratio will reduce as people start to realize that this inefficiency exists in the market). This means that in some buybacks, any small shareholder tendering shares will see the company accept all his tendered shares. So, one can risklessly obtain the spread between the market price & the buyback price.

Now, time for some examples:

1. Vardhman Textiles: The company announced a buyback of 62,60,869 shares @ price of ₹ 1150/share through tender offer. As per SEBI rules, 15% of this (9,39,130 shares) would be reserved for the small shareholders. Shares could be purchased in the open market close to the record date (9th Dec'16) at a price of ₹ 1090/share.

That's a spread of 5% (₹ 1150/₹ 1095). According to the company's shareholding pattern, there were 49,30,621 small shareholders. So, the theoretical acceptance ratio for small shareholders was 19.05% (9,39,130/49,30,621). As per historical trends, at such theoretical acceptance ratios, all shares are generally accepted by the company since small shareholders do not tender their shares. Anyone could have bought ~180 shares from the market & tendered them to the company to make a risk-free 5.5% in less than 2 months. That's an annualized return of more than 33%, risk-free.

2. Vardhman Acrylics: The company announced a buyback of 1,38,00,000 shares @ price of ₹ 50/share through tender offer. As per SEBI rules, 15% of this (20,70,000 shares) would be reserved for the small shareholders. Shares could be purchased in the open market 2 months before record date (13th Jan'17) at a price of ₹ 46/share.

That's a spread of 8.7% (₹ 50/₹ 46). According to the company's shareholding pattern, there were 76,41,570 small shareholders. So, the theoretical acceptance ratio for small shareholders was 27% (20,70,000/76,41,570).

As per historical trends, at such theoretical acceptance ratios, all shares are generally accepted by the company since small shareholders do not tender their shares. Anyone could have bought ~4,300 shares from the market & tendered them to the company to make a risk-free 8.7% in about 4 months. That's an annualized return of more than 26%, risk-free.

If the money that was deployed for tender offers was lying in an FD, it would have earned an annual return of 7%. By using it in tender offers, we are able to earn locked/risk-free rates that are 4-5x the FD rates. It's impossible to get 30%-40% annualized returns in any formal debt market except distressed credit. Such usurious rates are only earned by the informal informal money-lenders in villages & credit card companies (through hefty penal charges from defaulters).

So by participating in selected tender offers we are, in effect, able to lend money for short periods at usurious rates. This makes tender offers a perfect place to hold idle cash for 2-3 months, with almost no risk. This helps when you’re searching for long-term investment ideas & in the meantime you don’t want your cash to earn measly returns in a savings account/fixed deposit.

Note: This is not an investment recommendation of companies mentioned in the Case Study. One must carefully calculate the theoretical acceptance ratios before investing money in tender offers.

What does one do when faced with an over-valued market? Deploying capital into fully-priced opportunities is very risky. Almost all equity losses stem from chasing mediocre, richly-valued bets. In such situations, the world of corporate actions offers a unique way to earn returns relatively uncorrelated with mood swings of the general market.

Mergers are a type of corporate action that are easy to understand & exploit. The opportunity arises when a listed company acquires another listed company. The parent entity subsumes into itself the child entity which in turn ceases to exist post-merger. In lieu of their ownership of a ‘non-existent’ company, the shareholders of child entity are given newly-issued shares in the parent entity. The number of shares of parent entity which each shareholder of child entity receives depends on the share swap ratio announced before the merger.

For example: If company A acquires company B with a share swap ratio of 1:2, then shareholders of B will receive 1 share of A for every 2 shares of B held by them. If total number of outstanding shares in B is 10 L, then A will have to issue 5 L new shares which will be distributed among erstwhile shareholders of B. Post-merger, both shareholders of A & B will end up owning the combined legal entity & B will cease to exist.

A merger can be effected in India only after it has gone through a number of steps briefly listed below (entire process takes ~2 years).

| Boards of both companies approve the merger & its terms. |

| Approval for the merger is granted by the stock exchanges & SEBI. |

| Both companies apply for merger approval in jurisdictional High Court (HC) |

| HC orders Court Convened Meetings (CCMs) wherein shareholders & creditors vote to approve/oppose the merger. Each company conducts its own CCM. |

| Based on voting results of the CCMs & its own analysis, HC approves/rejects the merger |

| Approval from Competition Commission of India (CCI) is sought if the companies belong to the same industry. |

| Once HC & CCI approve the merger, NCLT conducts its own hearing to grant the final nod. The hearing stretches through multiple days over 1-2 months. |

| If satisfied with all aspects, NCLT approves the merger. |

| Parent company tables the NCLT approval in its Board Meeting. |

| Upon receiving the stamped approval order from NCLT, companies submit the same to the Ministry of Corporate Affairs (MCA). Merger is now effective. |

| Record date for swapping the shares of child company with parent company is announced. On the Record Date, shares of child company stop trading on the exchanges. |

| After ~3-4 weeks of record date, shareholders of child company receive the shares of parent company. |

Since the swap ratio is already known & both entities are listed, interesting opportunities arise as every merger heads towards the final stage step-by-step. In the example used above (of 1:2 merger), if A’s share was quoting at ₹ 100 & B’s share was quoting at ₹ 40, one could purchase 2 shares of B for ₹ 80 & then post-merger would receive 1 share of A, worth ₹ 100 (25% spread earned through this operation). 2 implicit risks one is taking in this operation are:

• No statutory authority would object & the merger would sail through. (Event Risk)

• A’s share price would not drop below ₹ 100 before the merger process is over. (Market Risk)

As each statutory approval is received, the probability of the merger going through increases. So, with each approval the spread between share prices of child company & parent company reduces.

In case the merger falls apart due to objection by any statutory authority, the closing spread between child & parent entity’s share prices will widen within no time & anyone owning child entity’s stock in the hope of catching the spread will lose capital.

NCLT is the final statutory authority whose decision can make/break a merger. After NCLT approval, event risk ceases to exist. And you can be certain the merger will sail though. Naturally, the spread is expected to be lowest after NCLT has given its nod.

Time for some real-life examples:

1. Suprajit Engineering-Phoenix Lamps Acquisition: A case of closing spreads

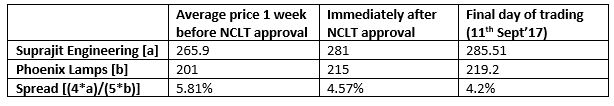

In Apr’16, Suprajit Engineering announced acquisition of its listed subsidiary Phoenix Lamps. Suprajit offered 4 shares for every 5 held by shareholders in Phoenix Lamps (swap ratio = 4:5). The merger went smoothly through all the steps described above.

NCLT granted its approval on 17th Aug'17. The company fixed 12th Sept’17 as the Record Date for determining the shareholders of Phoenix Lamps who would be given newly-issued shares of Suprajit Engineering. Shares of Phoenix Lamps stopped quoting on the exchanges on the Record Date.

The share price movements & closing of spread is shown below.

As can be seen above, after NCLT granted its approval, the spread dropped from 5.81% to 4.57%. But even now, one could see a spread of 4.6%. So, one could buy Phoenix Lamps shares from the market & after 2 months post the Record Date would get Suprajit Engineering shares in his account. This was not a risk-less opportunity. To earn this return of 27% p.a., an investor would still carry the market risk of Suprajit’s share price dropping before getting the newly-issued the shares.

Since the spreads were very small, we chose to stay away from this merger. Most of the times, it pays to pass on opportunities where you can’t foresee juicy returns.

2. United Phosphorus (UPL) acquires Advanta: A case of mispricing of exotic instrument

On 23rd Nov’15, UPL announced acquisition of its listed subsidiary Advanta. The boards of both companies approved the merger & the process was put into action. As per terms of the merger, Advanta shareholders would get 1 common share and 3 preference shares of UPL for every share held in the company on the record date (2nd Aug’16). These UPL preference shares were optionally convertible into UPL common shares any time after being issued (@ a ratio of 10 UPL common shares for 471 UPL preference shares) & would be redeemed at par (₹ 10) 18 months after issuance. Also, holders of these preference shares would get 5% annual dividend.

All approvals were granted smoothly.

The share prices just before the Record Date are shown below:

One could have bought Advanta shares close to record date & made a killing here by getting preference shares at less than half their true worth! That’s ~100% returns in 2 months’ time! What’s more? UPL trades in the F&O segment. So, the best way to play this merger was to not only buy Advanta shares before the record date but also short UPL shares to lock the returns. Near-month UPL futures (ending Aug’16) were quoting at ~₹ 626.

How did we know that preference shares would list at prices close to their arbitrage-free price (₹ 13.26/share)? What if they listed at a big discount to their true worth? What if they were illiquid? We were confident because these shares were convertible into common shares at the discretion of the shareholder. A discount would prevail if there was no conversion option available, as is the case with DVRs. Post listing, as expected, the company posted on its website application forms for preference shareholders to convert their holdings into common shares, if they wished to.

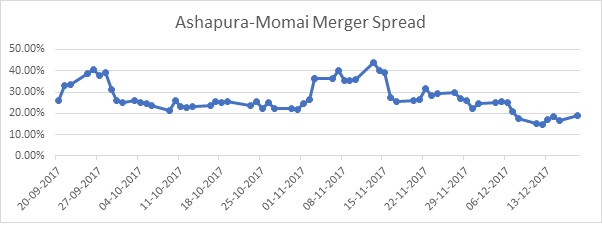

3. Ashapura Intimates Fashion acquires Momai Apparels: A case of exploiting uncertainty

On 31st Mar’16, Ashapura Intimates approved merging its listed subsidiary Momai Apparels into itself. Shareholders would receive 10 shares of Ashapura Intimates for every 27 shares held by them in Momai Apparels on the Record Date. The merger went through the usual process (described earlier) over next 1.5 years.

This was a special case of exploiting impatience under uncertainty. On 28th Sept’17, the company announced that Mumbai bench of NCLT had granted approval for the merger. Now, they would wait for the stamped order which would be filed with the MCA. In most cases, there is 4-5 days gap between NCLT approving the merger & companies receiving the stamped order by post. In this case, for some reason, the company did not receive the stamped order. A full month passed by. In the meantime, people who had bet on the clearly-visible arbitrage lost patience & the spread between the shares widened.

Markets hate uncertainty. And we love it because it is always accompanied with very favourable payoffs. (We will soon another case study shortly on dark trades of uncertainty & supernormal returns they offer.)

One phone call to the Company Secretary of Ashapura Intimates & checking the NCLT website told us that this was a genuine case of delay. NCLT website clearly showed that merger had been approved. The CS told us that the company wanted to consummate this deal ASAP & that company lawyers were in touch with NCLT to track the stamped order.

The stamped order finally reached their offices on 15th Nov’17, & the company declared the Record Date as 20th Dec’17. Meanwhile, this is how the merger spread evolved through the entire saga:

• On 28th Sept’17, NCLT approved the merger. Spreads dropped post this date (from 40%+ to ~24%) as event risk was drastically reduced.

• In the month of Nov’17, spreads jumped as arbitrageurs lost patience. It had been more than 1 month since NCLT had approved the merger yet there was no sign that the deal would be consummated soon. Spreads jumped to even more than 40% on some days as shares of Momai Apparels dropped below ₹ 140. Of course, we bought Momai shares by truckloads.

• On 15th Nov’17, Ashapura announced that it had finally received the stamped order from NCLT. Share price of Momai Apparels shot up & spreads dropped as all event-specific uncertainty was removed. Now, it was only market risk (risk of Ashapura Intimates shares falling) as companies completed their paper work. Ashapura Intimates does not trade in the F&O segment, so there was no way to hedge this risk.

• Even on the last day of trading (1 day before the Record Date), there was 19% spread available for anyone willing to take the market risk that Ashapura shares will not fluctuate much over next 2 months.

We bought in the month of November as spreads touched 40%+, exploiting others’ impatience. We continued buying even after NCLT order was received. After all, there was still 20% return available to be made in next 2 months. However, market risk hit the Ashapura Intimates scrip post the Record Date as the shares dropped from levels of ₹ 525 to around ₹ 450.

At the time of purchase, we expected to make a return of 35% in 2 months. Instead, due to fall in the price of Ashapura scrip, we could only make 15%. (That’s still a very acceptable annualized return of 90%.)

Events post our purchase reinforced the most important rule of investing: you should bet big only when you have a high margin of safety on your side. We made this bet only at costs where potential returns looked juicy (at least 20%+ in 2 months). (Recall that we did not participate in the Suprajit-Phoenix Lamps merger because, with 4.6% spread, we were not getting adequately compensated for the market risk.) In this merger, even when things didn’t go as per our expectations, we made returns that were more than acceptable to us.

Disclaimer: This is not an investment recommendation of any of the scrips mentioned. Only an indicative case to show how capital markets throw such opportunities to the patient buyer. We, & our clients, currently have no position in any of the companies mentioned.

There are times when one does not need to work hard to find opportunities in capital markets. All one needs to ask is what the latest fad in global finance is & then dig for opportunities in the opposite direction. After all, the best bets become available when others ignore them. We recently used this principle to locate an undervalued company that was shunned by everyone due to the ongoing trend of ESG investing.

What Is Environmental, Social, and Governance (ESG) Investing?

ESG Investing refers to a set of standards for a company’s behavior used by socially conscious investors to screen potential investments. Environmental (E) criteria consider how a company safeguards the environment, including corporate policies addressing climate change. Social (S) criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. Governance (G) deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Lately, many global funds have added a screening criterion of high ESG score in the companies they invest in. These companies are typically renewable energy companies, electric vehicle firms, organic food players & climate change research companies.

While we applaud the spirit behind many of the ventures aiming to do good for the humanity, we feel that financing of a company should be governed by one criterion only: the ability to generate healthy returns on investment. Here is a piece of quote we love from the book Value Imperative: Managing for Superior Shareholder Returns:

"The objective of our company is to increase the intrinsic value of our equity shares. We are not in business to grow bigger for the sake of size, nor to become more diversified, not to make the most or the best of anything, nor to provide jobs, have the most modern plants, the happiest customers, lead in new product development, or achieve any other status which has no relation to the economic use of capital. Any or all of these may be, from time to time, a means to our objective, but means and ends must never be confused. We are in the business solely to improve the inherent value of the equity shareholders' equity in the company."

We too like to keep it simple. When we manage your capital, we have only one objective: to generate a healthy return. Everything else is secondary.

We have no qualms about investing in chemical companies, oil & gas firms, cigarette players, global weapons manufacturers, fast-food giants, etc as long as we feel that potential returns are adequate. We feel that imposing any handicap on a fund, like that of investing in so-called ‘responsible businesses’, limits a fund manager’s opportunity set.

In fact, financial history shows that whenever everyone joins the bandwagon to invest uni-directionally, opportunities multiply in the areas that get ignored. For example, in the dot-com boom of the late 90s, boring, old brick-&-mortar businesses were selling at dirt cheap valuations because there was nothing cutting-edge about them. In the 2006-07 boom, as everyone went overboard on banking, infra & real estate investing, it was the consumer-facing businesses that made for excellent investments. Today, many businesses that have low ESG scores have been shunned by global funds & are hence available at attractive valuations.

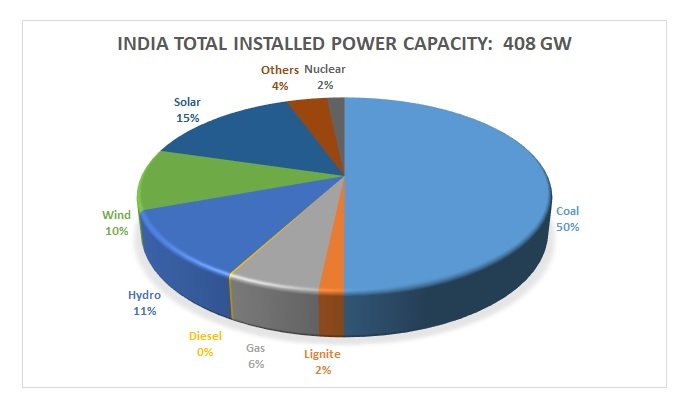

One such company we came across last year was Coal India Ltd. The company mines coal & supplies it by rail to coal-based thermal power stations across the country. Being a domestic monopoly, it is responsible for 85% of India's coal production.

India has a total installed electricity generation capacity of 408 GW of which 205 GW is coal-based thermal capacity (~50% of capacity mix). Out of total annual power generation of 1,500 BU in India, coal-based thermal stations generate 1,066 BU (~71% of generation mix). This requires an annual supply of 700 million tons of coal, lion’s share of which is supplied by Coal India.

Over the last few years, share of thermal power in India's electricity capacity mix has been reducing at the expense of solar & wind power. At COP26 in Nov'21, India has committed to achieving a renewable energy mix of 280 GW of installed solar power & 140 GW of installed wind energy by 2030. No new thermal power projects are being commissioned as the country is expected to adhere to these targets. Many nations have committed to similar targets of renewable energy generation. This is the reason why coal mining companies & thermal power plants across the world were quoting at dirt cheap valuations last year: coal was being phased out of every country's energy mix gradually.

We found that Coal India was quoting on the exchanges at near-bankruptcy levels last year. In such cases, one needs to make a realistic assessment of prospects of the business. That's where the opportunity lies. In this case, one needs to ask if thermal power generation would really cease so soon & if so, can renewables take over the entire energy load of a nation so quickly?

A solar power plant generates most of its energy in afternoon while wind mills generate power only when wind speed exceeds 14 kmph. Both run at a capacity utilization rates of 20-25%. There is no viable battery storage that can store the power generated during peak-generation times to be released later into the grid during peak-utilization times. So, all the renewable power generated is transmitted LIVE on to the grid. But, power utilization peaks in the evenings in India. Thus, there is no alternative to fill this gap except thermal power. So, despite the lofty goals for renewable power installation, thermal generation is not going anywhere, at least until mass-scale battery storage is invented.

Now, Coal India by itself is a very poor business, thanks to govt policies. It subsidizes the use of coal by thermal power plants by selling 90% of its output much cheaper than international rates. Only 10% of coal mined by it is sold at international market rates (through e-auctions). Plus, 40% of its revenues go into paying its employee salaries & wages, leaving almost nothing for the shareholder. In fact, the company was sued by a UK-based hedge fund in 2012 which alleged that Coal India's policies hurt its minority shareholders.

These aspects make Coal India a very mediocre business to hold for a long-time. But even a mediocre business can be a very attractive investment when available at dirt-cheap prices. A low buying price goes a long way in compensating for the poor fundamentals. In Dec'21, Coal India was available at a market cap of just Rs 86,000 cr even though it had paid an average dividend of Rs 11,000 cr over preceding 5 years. That's a dividend yield of 12%+ when interest rates by bank FDs were less than 6%. Companies quote at such yields only when they are going out of business soon. In this case, it was probably because the company was shunned by global funds because "it contributes to pollution" & so it fell out of their mandate. Or may be global fund managers thought no price is low enough to buy a mediocre business.

Funds, like ours, that are not tied down by any mandate (except to generate returns) saw this as an opportunity to load up the stock in our client portfolios. We are always on a look-out for such 'hated stocks' that are shunned by others. We bought the scrip in Dec'21 at an avg price of Rs 140/share & held it till Aug'22. As can be seen from the graph below, this gave us an easy 66% return (including dividends) in a short span of 9 months, as markets started pricing this company realistically.

Disclaimer: Please note that every stock that trades at distress valuations is not an investment opportunity. One needs to do a realistic evaluation of the business before investing. Cascade Capital & its clients do not hold any position in Coal India currently.

Blog

This section features some of our thoughts on the investment process & Indian markets. While we adhere to value-investing principles, our techniques & thoughts keeps evolving as we turn more stones. Companies mentioned here are not investment recommendations.

Warren Buffett’s partner & one of the savviest investors of all time, Charlie Munger, describes investing as a pari-mutuel betting system. What’s pari-mutuel betting & how is it different from regular betting?

In regular betting that you see in a casino, odds/payoffs of a bet do not change with the number of people willing to take that bet. For example, on a roulette wheel, everyone who bets on Red will get the same payoff, say twice the bet amount, irrespective of the total number of people willing to bet on Red.

Investing in markets doesn't work that way. The odds/payoffs of every investment depends on the number of participants taking your side of the bet. More the participants taking your side, lesser will be the payoff for each participant.

Since payoffs reduce with the number of people, one can't bet on consensus opinion and hope to make outsized returns. Eg. In real estate investments, properly constructed houses in posh localities are already priced much higher than other houses in other localities. So, just because you spotted a good asset (a house, in this case) doesn’t mean you’ll make great returns on it because you’ll be paying commensurate amount of money to purchase it. In equity investments, a high-quality fast-growing company will already be priced at a much higher P/E multiple. If we are in a deflationary environment and the central bank is expected to cut rates, yields of bonds come down much in advance of the announcement. So, there is usually nothing to be gained by betting on the 'truths' known to everyone. That's because usually (though not always) this 'truth' is reflected in the prices.

In fact, betting with the masses when they are wrong is a sureshot recipe for financial disaster. Look at what happened to IT stocks post the 2000 bubble or to real estate stocks in 2008. For recent examples, take a look at the two-year price chart of companies like Blue Dart, Tata Motors & Strides Shasun to see what happens when 'popular' companies of yesterday fall from their pedestials.

Money is made by betting on mispricings in the market, i.e. areas where the market/masses are wrong. But to bet against the crowd requires a lot of fortitude & a different kind of mental wiring. Often, prices go against you & there is an urge to exit the investment. That's why making money in markets will never be easy. First, real bargains are not easy to find & secondly, it requires a lot of conviction to hold on to these bargains, especially when prices go below your cost of purchase & make your stomach churn. Oh, the game your mind plays at those times! You are constantly forced to ask yourself 'Is it possible that the market knows more than I seem to know about this company?' Everyone likes to call himself a contrarian investor, but it's a tough craft to practice.

Investing requires twin emotions of arrogance & humility in right proportions. You must have the arrogance to believe that the asset you are purchasing/selling is undervalued/overvalued & that the entire market that is setting the price for this asset is incorrect. This is called Necessary Arrogance. If you don't have it, you'll never hold any investment, especially when the prices move against you. At the same time, you must have the humility to acknowledge that there are times when the market might know more about the asset than you. At those times, it's best to acknowledge your mistake, learn lessons & exit the investment.

To conclude, real money is made betting where the masses are wrong. And needless to say, you need to be right! No, it's not easy.

One of the ways we invest is by recognizing what has worked over & over again and then exploiting that phenomenon. This type of Pattern Recognition has not only provided us a number of fertile opportunities but has also protected us from making many financial follies. Patterns can be analyzed by a careful study of businesses across industries & then connecting the dots between them.

Here are some of the patterns that we have recognized & exploited:

1. Insider buying by a competent promoter: Usually, there is no surer indication of an undervalued company than its promoter buying company shares from the open market. According to SEBI rules, all buy/sell transactions of company shares by promoters need to be reported to the exchanges. One must realize that no matter how good an analyst's skills are, he'll never match the knowledge of a promoter who has been in the industry for long & has access to a much better set of company-numbers than him. Of course, it’s possible that the promoter is wrong in finding his company undervalued by the market. So, it helps to ask 'Why is the market undervaluing this company & what does the promoter see in his company that the market fails to see?' before acting blindly on his transactions.

In the wake of demonetization, there was a temporary but significant meltdown in stock prices. After the meltdown, some of the promoters, who are well-respected for their capital allocation acumen, were busy buying buying their own shares from the open market. Many of these companies have created a lot of wealth over time. We have found that coat-tailing such promoters into their investments has proven to be very beneficial in the past, & this time we acted on this insight for our clients. To say that this worked out well would be a big understatement.

2. Cyclicity: Cyclical industries go from euphoria to despair & back. In times of bullishness, every new promoter wants to open a business in these industries & existing promoters want to expand their capacities. Prices of output keep rising. Companies take on excessive debt to fuel their expansion dreams quickly. (Nothing sedates rationality like large doses of effortless money - Warren Buffett). Mood is euphoric & the sector becomes a darling of capital markets as every firm is priced much higher than what is justified by its fundamental earning power. This leads to excess capacity which eventually drives down the price of output. Pendulum now starts to swing towards despair. Many over-leveraged players perish as they are unable to pay down even their interest cost, let alone the principal. Banks get stuck with NPAs & companies start deleveraging by selling their assets. Mood turns to despair & markets start to hate the once-loved sector.

These cycles, which are governed by demand & supply, have been repeating since time immemorial & will continue to repeat. It's not very difficult to know where we are in any cycle. The difficult (impossible?) thing is to predict how far the cycle will run before making the inevitable turn. Highest returns are made when the investment is made at the point of maximum despair where it is not clear if the cycle will ever turn.

Economic prospects of cyclical industries are not the only phenomena that swing like a pendulum. There are credit cycles which are strongly correlated with cycles in valuations in market. Loose credit is associated with bull markets (increasing multiples) while tightening credit is associated with lower market valuations.

It is very important for a capital allocator to know where he stands in these cycles & make decisions accordingly. Read the MOIL case study for more on this.

There have also been a number of the patterns we have recognized that lead to financial disasters:

1. Excessive Leverage: If you study corporate failures & frauds, you'll realize that a disproportionate share of them would have their roots in excessive leverage. Promoters take debt on books of their companies to fuel their expansionary dreams. This usually happens when credit is available cheap. Nothing deludes people's senses like cheap money. Same goes for speculators who indulge in margin trading in bull markets. Soon, one of the three things happen: the era of easy money ends (credit cycle turns) or promoters' dreams meet the gruesome reality or the bull market ends. And when this happens, all hell breaks loose.

We have seen many lose their shirts in capital markets & do not wish to play with fire. We abhor all leveraged transactions: futures & options, unless we are going for a hedged transaction. Having read about so many leverage-induced bankruptcies, we are also very sceptical of companies which employ excessive debt. For a recent story of debt-fuelled growth gone all wrong, read this piece on Shree Renuka Sugars.

Pattern recognition has taught us that business & investing decisions are not very different from life decisions. 'What has worked' principle indeed works in life, as well.

Happy Investing!

Happy Investing!

They say 'No knowledge is better than half knowledge.' Unlike half knowledge or an illusion of knowledge, total ignorance will never get you into trouble. This is true in all fields that require expertise. Before coming to investing, let's see an analogy in a different field: medicine. Suppose you are showing symptoms of a commonly-known disease. If you had no knowledge about medicine & diseases, you would simply visit a clinic & get yourself properly diagnosed by a doctor. However, if you wanted to try your own hand at diagnosis based on your limited experience, there's a fair chance that you would misdiagnose yourself. Not a very smart thing to do with your health.

Same goes for investing & speculation (commonly known as 'trading in shares'). When a person speculates, he does so knowing that he has no special insights about the company. So, after buying the shares, if the price moves against his position, he closes that position (at a pre-decided stop-loss price) & moves on.

So, speculation by itself is not dangerous, if done smartly. A smart speculator never lets his ego get in the way of his survival by holding on to a losing position below a price point. He is also careful to keep each of his positions small.

An investor, on the other hand, knows the worth of his company & has a rough idea of the potential upside before putting his money. He has formed his opinion after thorough research of the company & its prospects. If the price of his stock goes down after he has bought a position, unlike a spculator, he is only tempted to add more. In terms of returns, speculators/traders keep nibbling while investors take infrequent but big bites. Only a handful of people have really made big money speculating on stocks.

Illusion of knowledge: Unlike a smart speculator, an amatuer behaves differently. What gets him in trouble is that once price moves below his cost, his mind starts playing games with him. He now starts to consider his position as a 'long-term investment'. And that's one of the most dangerous acts in markets. This is where the illusion of knowledge creeps in. Worse still, new stop losses are imagined by him & he doubles down his bet by buying more of the position at lower prices to reduce his average cost of purchase. We have seen retail investors holding on to dud stocks for years, in the hope that price will cross their cost of purchase one day. Many start reading annual reports of companies they hold AFTER the shares have crashed to see if there is ever a chance of recovery. They are classic examples of people living in the illusion of knowledge.

Half knowledge: On the other side are also people who have convinced themselves that they hold investment positions because they have superficial knowledge of their company/industry. Even in the absence of any positive/negative news about the company, if prices move in their favour, they will have convinced themselves that they possess superior investment insight. And if prices move against them, they'll panic the moment prices dip below their cost of purchase. These speculators-in-the-guise-of-investors sell all their positions & are out of the market in the next sizable market correction.

Before taking any position, one must be clear: is this an investment or a speculative position? And it must be treated so throughout the holding period. We have observed many cases where the nature of position (speculation or investment) usually becomes clear from the participant's actions when the price falls to, say 10%/15% below his cost of purchase (everything else remaining the same). So much for conviction!

There is nothing wrong with speculating on stocks, as long as it is done right. We do not indulge in speculation & have only potential investment positions on our radar. After all the research, before committing money, we ask ourselves: everything else remaining the same, if this stock price moves 20% below our cost of purchase, will it scare us or tempt us (to accumulate more)? That answers the far more important question for us: do we have any business investing our clients’ hard-earned money in the shares of this company?

Disclaimer: Cascade Capital does not consider speculative positions for its clients.

Would it not be really good if one could buy stocks right at the bottom of the equity market & sell them near the top? One would have enjoyed the gains of bull runs & saved himself the agony of losses experienced by many in 2001-02 & 2008-09. The supposed skill of entering & exiting the equity market at precisely right moments is called Market Timing. We call it a 'supposed skill' because no one possesses this skill, not even experienced investors who have seen multiple market cycles. Let alone the entire market, no one knows how any stock will move in the short run. Trying to time the market is therefore futile. Very similar to real life, in equity markets too you can't have your cake & eat it too. Living with volatility is the implicit contract that we investors sign with the market to aim for the holy grail of super-normal returns on capital.

Having said that, is it really rocket science to judge the current temperature of the market, especially at extremes? Having studied market history, one knows that sentiment of people swings like a pendulum between despair & euphoria. And most buying should be done when businesses are priced at ridiculous bargains during times of despair. Selling, which is far more difficult, should be done when most participants are super bullish. When one trains his mind to behave in a way that is contrary to the behavior of the masses, one ends up implicitly, though imperfectly, timing the market.

Behavioral Edge in a Market Mania

Investing is a game you play against other participants. As a group, investors will only make the return that market makes on average. However, since we are all transacting with each other, few of us will make superlative returns while most will make subnormal ones. That's how a zero-sum game operates. Over long-term, our returns reflect the edge in our thinking, analysis & behavior. After spending 1-2 years, it's easy to develop an edge in thinking & analysis. It's the edge in behavior that separates the best from the rest.

Unless you can act prudently, all analytical skills are futile. To share a cricket analogy, what if you encountered a cricketer who has 20% better batting skills than Sachin Tendulkar when practising in the nets, but gets absolutely decimated under the pressure of a real international match. Will his career last long? Similarly, in investing, all the analysis in the world cannot save you if you succumb to the pressure of your emotions.

So, what exactly is the behavioral edge that makes a good investor? Anyone who recognizes that temperament of players in the market keeps changing & acts accordingly has an edge over others. Warren Buffett says investing doesn't require an IQ of 120. Instead, it requires that you have the right temperament: the ability to keep your head while everyone else is losing theirs. And everyone loses their heads in a market frenzy. During heady times, there is a tendency to believe that good times will prevail forever. Everyone around you is making great returns in stocks that are market darlings. If you are watching from the sidelines, you are gripped by FOMO (fear of missing out: a fancy term for envy). Social media only accentuates these feelings. And it's wrong to believe that 'experienced fund managers' are immune to this powerful behavioral bias. That's the reason many mutual funds (which employ analytical experts & sectoral specialists with years of experience) get destroyed during market crashes. That the fund houses open new funds after the carnage & their managers get to keep their jobs is a story for another time. The bottomline is that behavioral edge is very hard to build & most institutions succumb to the same forces as retail investors during a market frenzy.

Midcap Frenzy in end 2017

Though broad markets have been overvalued over entire 2017, from Oct'17 onwards, many stocks lost all sense of connect with their fundamentals. This was more so in the midcap/smallcap segment than anywhere else. There was talk of doubling/tripling of money in these shares in 6 months! Nifty Smallcap Index PE ratio crossed 100x. Shares of companies with questionable corporate governance practices were touching new highs daily. These were very interesting times so we captured some symptoms of froth formation that we observed:

• Market catches the fancy of general population: When market rises relentlessly, it captures the imagination of mass public which sees this as an easy game to make a quick buck. People on the way to their offices would trade stocks in Metro/cabs. Ola cab drivers were trading stocks while waiting for their passengers. Like moths drawn to a flame, most participants get sucked into the markets at exactly the most dangerous time. Some images below.

• IPO Mania: Most IPOs are sold to public only when there is ebullient sentiment & the masses are eager to lap up anything that is thrown at them. In this period, one could see an avalanche of IPOs that were sold & subscribed to at many multiples of the subscription size. They say that IPO frenzy peaks right at the bull peak when many weak-quality promoters start selling dud shares to the gullible public. It makes us smile when domestic brokerage houses (ICICI Securities, HDFC AMC, etc) talk about the maturation of Indian investors to invest in equity, mega-trend of financialization of Indian savings & then start selling shares in their own companies. If these were indeed permanent long-term trends, why would any promoter sell ownership to public instead of enjoying the fruits himself? What do these brokerages know about investor behavior that their new investors themselves don't know?

• High-decibel Mutual Fund Campaigns: Not surprisingly, this euphoria was exploited by Mutual Fund (MF) companies & their distribution agents to sell MF units to the salaried class which wanted to participate in the party. This class, though obsessively risk-averse, has been betrayed by its favorite asset class (real-estate) over last 10 years & has now started to believe that equity market is the panacea for its investment needs. By employing the high-decibel advertising campaign 'Mutual Funds Sahi Hain', MF houses sold the idea that investing through Systematic Investment Plan (SIP) will save them from the rout when it comes. Only time will tell how many will actually keep investing a portion of their hard-earned salary every month when their funds go deep underwater, as many have started to.

• Overseas investors itching to join the game: While the party was on, and we were at pains to deploy money, we had potential clients enquiring about our services all the way from the US & Europe. These people have no knowledge of Indian corporates & regulatory structure, operate at fringes & would be out at the first sign of volatility. Usually, we take clients onboard only after we are convinced that they possess an 'equity-mindset'. Talking to these people convinced us that excited by reading news about rising markets, they were only impatient to make quick money. We passed the opportunity but their excitement served as an important warning signal for us.

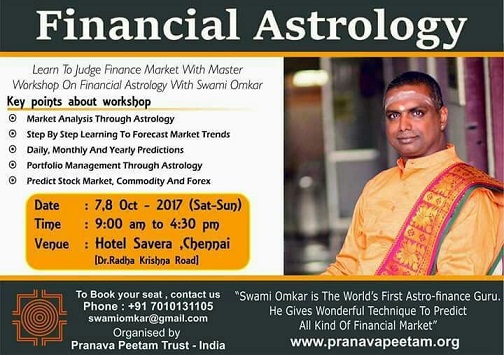

• Stock Tips on SMS: A new trend that started in the last 12 months was sprouting of many fly-by-night stock 'advisories' that call people to sell them stock tips. Most such companies are one-room enterprises that operate from Indore & exploit retail investors' ignorance & eagerness to participate in the market. It's easy to pull off such ventures in a country with weak regulatory oversight. Another example of a service that comes up in every bull market is given below. These services are more popular than you would think.

Justifications & Antidotes

There is an old saying about human behavior: Man is not a rational animal, but a rationalizing one. No matter what his deeds are, he will always appear reasonable to himself. He will justify all his prior beliefs & will see in any evidence only new reasons for his long-held views. Besides politics, nowhere is this more visible than in stock markets. Here, price always drives the justification, instead of vice versa.

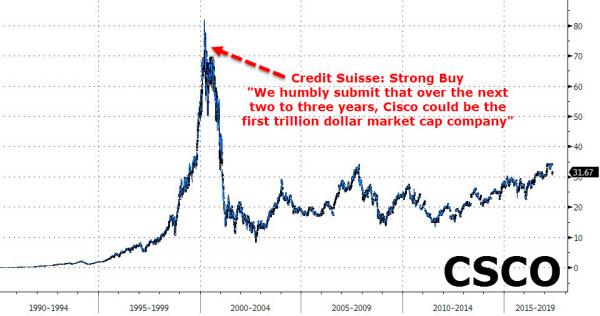

Even at the peak of dot-com bubble, when Cisco's share prices crossed stratospheric levels, 'experts' at Credit Suisse justified its valuation.

Below are some of the justifications of overvalued midcaps & smallcaps that we read on social media in Jan’18. If one thinks independently with a clear head, none of them stands the test of logic. But in a market frenzy, who cares!

Justification 1: India is a growing economy. No other big economy is growing as fast as India is. That's why equity markets are always expensive here. Get used to it. There is no alternative.

Antidote: A growing economy doesn't necessarily translate into rising corporate earnings. It is the earnings growth that counts, not merely economic growth in the country. And even then, one must buy stocks that are under-priced & not those where market is already discounting the earnings growth. A high purchase price leaves no margin of safety in case the supposed growth fails to materialize.

Justification 2: There is so much momentum in smallcap stock prices. Might as well make hay while the sun shines & enjoy the rally. This time won't come again. See this as an opportunity to make quick money & preserve capital for the bear market.

Antidote: Momentum comes under the domain of speculation & not under investment. There is nothing wrong with speculating as long as you know you're speculating. We know some respected people who know how to play this game. More importantly, they know when to exit before the tide turns. We don't possess that expertise & we are sure nor do most market participants. We don’t want to be left holding the sack when the party ends. So, we will never buy a scrip we feel is overvalued in hopes of selling it at even more overvalued price-levels.

Justification 3: Last peak of the equity markets, in Jan'08, also marked peak-earnings growth. Subsequently earnings stalled, thanks to the global recession, so markets crashed. This time, while PE ratios of indices are near their peak, there is no earnings growth. Once earnings start growing, this PE multiple will appear only optically high.

Antidote: If indices are peaking despite poor earnings growth, it means they are being driven by a flood of liquidity taking the market higher & higher. Once the liquidity tide recedes, the end will be brutal. And would you buy a stock at elevated multiples when its earnings are not growing? If not, why would you apply a different yardstick to evaluate the market?

Justification 4: Experts on TV claimed 'Yes, valuations are high but I can’t foresee any black swan events. So, stay invested, irrespective of valuation.'

Antidote: Black swans CANNOT be foreseen. And neither can events that end a bull market. Even after the subprime crisis was public news in early 2008, no one in India could predict that equity-market party would end the way it did. So, don't think listening to news will help you avoid the next crisis. To preserve your capital, you will have to leave some money on the table. Sell when your stocks become overvalued & buy them only if you find them undervalued. Also, if you make financial/investment decisions after listening to TV experts, you might want to read this: According to Google, the phrase double-dip recession was mentioned 10.8 million times in 2010 and 2011. It never came. There were virtually no mentions of financial collapse in 2006 and 2007. It did come. So, next time someone makes the claim that high valuation is fair since he can’t foresee any negative events ahead, keep your wallet zipped.

How we avoided the midcap mania

When we looked at the midcap/smallcap space in late 2017, we were flummoxed by the valuations some of the stocks were quoting at. Many companies with very questionable accounting practices & shady past were quoting at PE ratios of 30x. And were rising without a pause daily. Even a cursory reading of their accounts would make one pull his hair.

While the midcap space was replete with gross overvaluation, large cap space still had some fairly priced securities. That's ironical since this is the segment that everyone is supposed to track. To give an example of the schizophrenic market, we found a high-quality large-cap automotive OEM quoting at cheaper multiples than its own lesser-known midcap tier-1 vendors. In last 12 months, we deployed our clients' capital in a concentrated manner in a few such high-quality largecaps. This was the only space we found that was relatively fairly priced (besides some special situations).

Was it difficult to select these companies? Not at all. It usually never is, since there is no information asymmetry in this space. The managements of most of these companies are ethical & participate in quarterly concalls. At most times, one would not find gross undervaluation in this space. While this means that chances of making superlative returns are low, one can still hope to make very decent returns provided that stocks are chosen wisely. Most of our long-term holdings are up by 25%-40% in last 12 months when broader markets have seen a carnage. Many midcaps & smallcaps have been crushed in last 6 months. Unfortunately, only very few of these are at Buy levels even now.

A new froth formation?

As we write this, Sensex has crossed 38,000 & Nifty PE has touched an 18-year high of 28x. The market is being driven higher by domestic inflows from salaried class through SIP/MF route & froth has started to shift to select quality largecaps, especially in consumer & private banking space. Today, in the name of high-quality, many stocks are being bought irrespective of valuations. Since the custodians of capital (MF managers) are judged on the basis of short-term performance, they tend to herd into known “safe” stocks. They forget the basic rule of investing: price determines the safety of returns. Eg. L&T, despite being a reputed name, was a very unsafe stock to purchase in the infra boom of 2007! What is happening now resembles the Nifty 50 Bubble in the US in 1970s when the masses believed that one could not go wrong purchasing reputed companies (IBM, P&G, Xerox, Polaroid, McDonalds), irrespective of the price paid. In the 1973-74 bear market, each of these blue-chips got crushed one-by-one.

While the red herring prospectus of brokerage IPOs would have you believe that Indian investors have matured & these fund flows are secular & not cyclical, we beg to differ. These newbie investors have not been tested in the markets. Almost no one has seen any sizable erosion of their wealth that older generations have experienced. If the midcap rout of last 6 months taught investors the importance of sticking to quality, future times will show them the importance of undervaluation while selecting stocks. It won’t be soon but it’s inevitable when that happens, a new set of people will learn a very old rule in finance: trees don’t grow to the skies.

Interesting times ahead. Stay tuned.

What can we offer you

- We charge zero fixed fee. We earn our keep only if you make decent returns through our investment recommendations.

- We don't work with distributors to sell our services. Never have, never will.

- We don't have a marketing team. Our service should be good enough to sell by itself.

- We are co-invested with you in every investment recommendation. So, your making good returns makes us happy too.

If you believe that:

- Equity is an asset class for patient wealth-creation rather than short-term speculative entertainment

- Purchasing equity is equivalent to buying fractional-ownership in a business & every buy/sell decision needs to be viewed accordingly

- Return of capital is more important than return on capital

- Your financial advisor should share the risk of each of his investment recommendations

- Have long-term capital (min ₹30L) that is free of encumbrances & short-term needs

then you may write to us on: helpdesk@cascadecapital.in

Contact Us

Cascade Capital

Cascade Capital Investment Advisors LLP

5th Floor, Nirman Bhawan

Sector 128, Noida

Phone: +91-7291091798

Email: helpdesk@cascadecapital.in